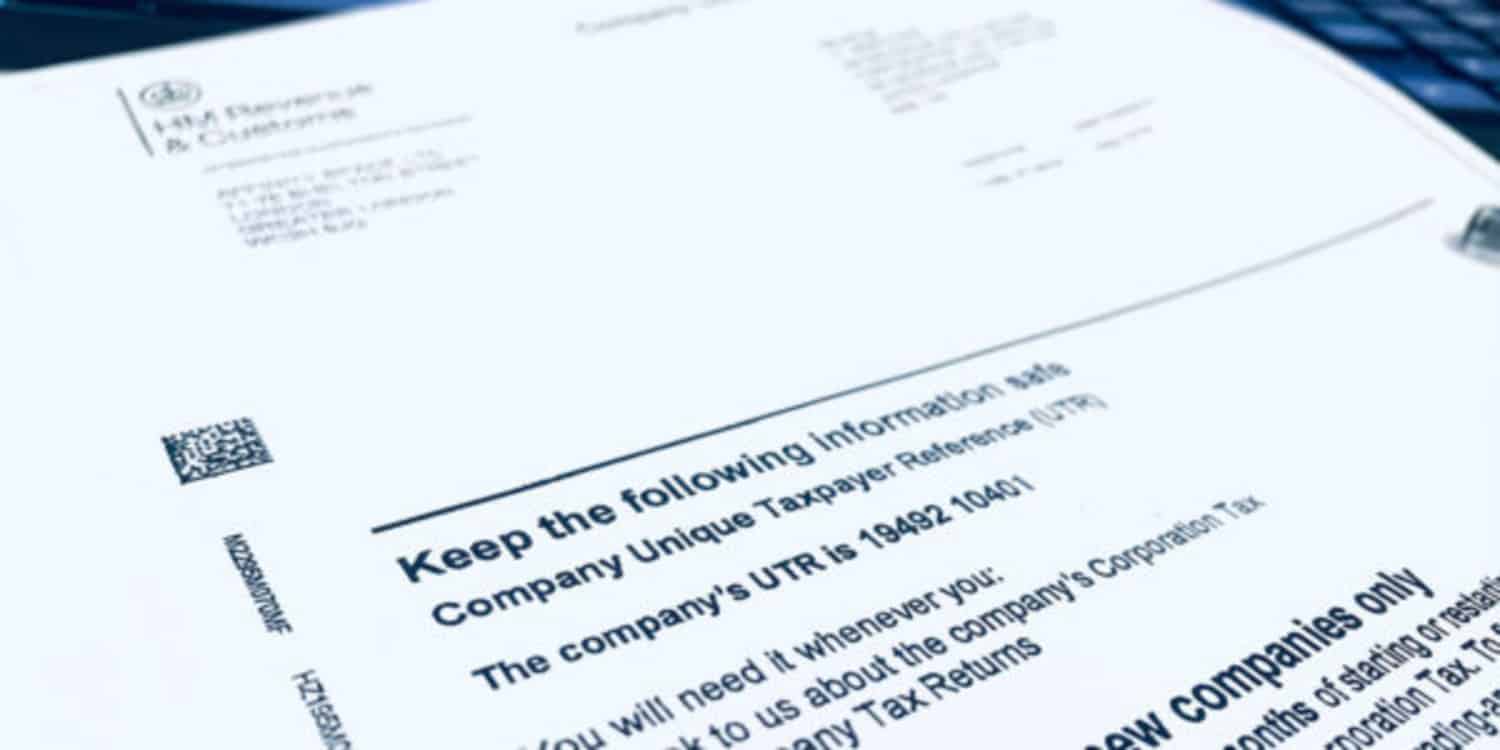

Corporation Tax Reference Number Utr | Often simply called a 'tax reference', a utr number comprises 10 digits. The tax reference number consists of three numbers, then several numbers, letters or a combination of both. Don't make the mistake of confusing the tax reference number with a unique taxpayer reference number! If you've lost track of this number you can request for the code to be resent to your registered office by calling: Defining a company utr number. Remember, you'll need your company utr number when it comes to submitting your tax return to hmrc, so it's worth keeping it in sight. If you've lost track of this number you can request for the code to be resent to your registered office by calling: Here is our guide for unique tax reference numbers. Utr numbers consist of ten digits and are unique to each person or business. We hope you find the guide informative. Utr stands for unique taxpayer reference. Utr numbers consist of ten digits and are unique to each person or business. It is unique to you and highly confidential just like your national insurance number. We also look at why you need the utr and when it is used. Sometimes referred to as a tax reference number, utr is an acronym for unique taxpayer the utr number will be required for a number of tax related issues, such as tax submissions to hmrc and the to register for corporation tax, vat, and paye. You'll find your limited company reference on all corporation tax letters sent to you by hmrc. Here is our guide for unique tax reference numbers. This code is issued by hmrc and consists of. Hmrc provide a utr number if you register for self assessment. Hmrc on 0845 366 7819. Your utr number is a highly confidential piece of information so you should never share it unless you're certain it's for the right reasons. You will need your company utr number when submitting the company tax return. Do i need to register for a utr after forming a. In this video we look at what a company utr (unique tax reference is) and how you can get one. A utr number is a 'unique taxpayer reference' assigned by hmrc to a company, a partnership, an organisation, or an individual who registers for self assessment. Do i need to register for a utr after forming a. We also look at why you need the utr and when it is used. Hmrc on 0845 366 7819. You will automatically get your utr number. A unique taxpayer reference is issued to all uk limited companies. Utr stands for unique taxpayer reference. Defining a company utr number. One of the most important numbers your company will receive is the unique taxpayer reference (utr). Hmrc provide a utr number if you register for self assessment. Where to find your unique tax reference (utr) number, what to do if you've lost your utr number, or how to apply if you do not have a utr number. Hmrc uses utrs to identify businesses and certain individuals for. Don't make the mistake of confusing the tax reference number with a unique taxpayer reference number! A company's unique taxpayer reference is a 10 digit number issued to all new limited companies. So to keep your bookkeeping simple and cost effective, make. Shortly thereafter, hmrc will issue a unique tax reference (utr) for your new company and send a letter to your registered office address. A unique tax reference number (utr) is made up of 10 numbers and is posted by hm revenue and customs (hmrc) to you when your company has been incorporated. A utr number is a unique 10 digit number issued by hmrc used to identify you or your company. In this video we look at what a company utr (unique tax reference is) and how you can get one. You will need your company utr number when submitting the company tax return. Defining a company utr number. The tax reference number consists of three numbers, then several numbers, letters or a combination of both. Utr is unique transaction reference number that is generated in rtgs system for uniquely identifying any transaction. Remember, you'll need your company utr number when it comes to submitting your tax return to hmrc, so it's worth keeping it in sight. Your utr number is a highly confidential piece of information so you should never share it unless you're certain it's for the right reasons. It will certainly be mentioned if you have received the document known as 'notice to deliver a company tax return. A unique tax reference number (utr) is made up of 10 numbers and is posted by hm revenue and customs (hmrc) to you when your company has been incorporated. Shortly thereafter, hmrc will issue a unique tax reference (utr) for your new company and send a letter to your registered office address. Hmrc also issues utrs for individuals. Don't make the mistake of confusing the tax reference number with a unique taxpayer reference number! Do i need to register for a utr after forming a. If you have a unique taxpayer reference, you will. Hmrc provide a utr number if you register for self assessment. They're used by hmrc whenever. The utr number is needed to register for corporation tax and to file your self assessment tax return (tax return) to hmrc.

A unique taxpayer reference is issued to all uk limited companies corporation tax reference number. Utr numbers consist of ten digits and are unique to each person or business.

Corporation Tax Reference Number Utr: Don't make the mistake of confusing the tax reference number with a unique taxpayer reference number!

EmoticonEmoticon